Saudi Industrial City in Punjab: Can Punjab This MOU into Steel and Smoke?”

By: Dr. Ghulam Mohey-ud-din

A city from an MoU? Pakistan’s Punjab has announced a Saudi-backed “industrial city” with sweeping tax and customs incentives and a fast-track approvals regime. It’s an eye-catching headline—exactly the sort of promise that stirs animal spirits in a capital-starved economy. But what, precisely, has been agreed—and what will it take to turn a ceremony photo-op into cranes on the skyline and paychecks in people’s hands?

What’s actually on paper

Over the past week, Punjab hosted a high-level Saudi delegation led by the Saudi-Pakistan Joint Business Council. Officials trumpeted a memorandum of understanding (MoU) to channel Saudi investment into Punjab across SEZs, industrial estates, real estate, hotels, healthcare, mining, transport and logistics. The Chief Minister publicly pledged “all necessary facilities and cooperation” to Saudi investors. That same push sits atop earlier federal–Saudi deal-making: last year’s signing of 27 MoUs valued at roughly $2–2.2 billion across multiple sectors. None of this is a final investment decision; it is a framework to negotiate projects.

Punjab has complemented the outreach with policy moves. In February, the provincial cabinet approved a “Zero Time to Start” policy to compress NOC issuance and front-load services in SEZs and industrial estates—explicitly designed to cut bureaucratic latency for investors.

Crucially, the fiscal incentive architecture is not being invented from scratch. Under Pakistan’s SEZ Act, both developers and enterprises are eligible for (i) a one-time customs and tax exemption on capital goods and (ii) a 10-year income-tax holiday from the start of commercial operations. Punjab’s investment bodies and SEZ authorities advertise those same benefits at the provincial level. Think of the new announcement as a political-commercial umbrella built upon an existing legal scaffold.

How attractive is the idea—economically?

If executed well, an investor-anchored industrial zone can be a high-leverage instrument for job creation, exports and technology diffusion. The incentive mix is competitive by regional standards, and pairing it with a “single-window” permitting regime lowers one of Pakistan’s chronic barriers to entry: administrative time. Add to that the depth of Saudi Vision-2030 capital seeking diversification plays abroad, and Punjab’s pitch—industrial land + approvals velocity + fiscal incentives—has a coherent logic. The Nation

There is also a strategic tailwind. Saudi–Pakistan ties have recently been upgraded—politically and financially—through renewed deposits, rolling economic cooperation and, more recently, a formal mutual defence pact. While defence treaties don’t build factories, they do reduce geopolitical risk premia and can lubricate inter-government problem-solving when projects hit bumps.

An abridged vresion of the article is published on "Paradigm Shift"The reality check: MoU ≠ money

MoUs are options, not obligations. They unlock due diligence, site selection, feasibility work and negotiation—but none of those guarantee capital formation. Pakistan’s investment history is littered with ambitious zone announcements that stalled on land assembly, offsite infrastructure, power reliability, FX convertibility, or simply policy whiplash. The current package will face the same gauntlet.

Five practical hurdles stand out:

- Bankable sites and offsite infrastructure. A credible “industrial city” needs shovel-ready land with clear title, graded plots, trunk infrastructure (power, water, gas, waste, road/rail access) and a financing plan. Without offsite capex commitments, incentives won’t bridge the gap between glossy brochures and viable unit economics. Punjab’s SEZ authorities have frameworks, but each site’s readiness is idiosyncratic and must be proven. PBIT

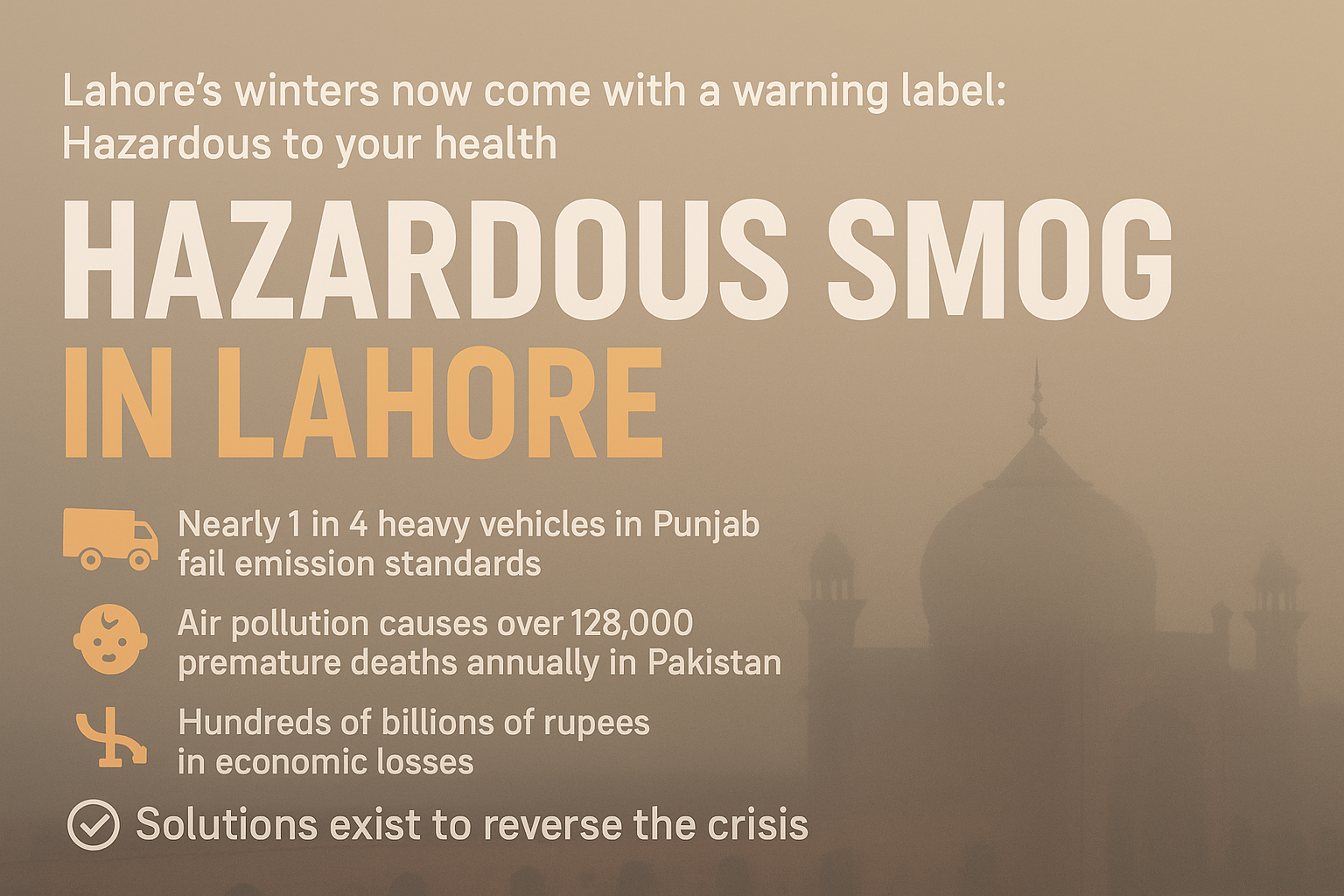

- Grid and gas reliability. Manufacturers price in unplanned outages and captive generation. Unless the project hard-wires dependable electricity (and, where relevant, gas) with enforceable SLAs—and ring-fences tariffs to avoid cross-subsidy drift—the cost of doing business will creep above the incentive benefit.

- FX and repatriation certainty. The 10-year tax holiday is meaningful; equally critical is confidence that dividends, royalties and capex imports clear without delay. Pakistan has periodically rationed FX under balance-of-payments stress; investors will seek contractual protections and escrowed mechanisms to mitigate convertibility risk. The SEZ regime’s customs and income-tax relief is law; FX assurances are policy-execution. invest.gov.pk

- Policy stability. The SEZ Act underpins the incentives, but investors worry about administrative reversals (e.g., delayed refunds, changed interpretations). Punjab’s “Zero Time to Start” policy is promising precisely because it converts intent into process—but continuity across electoral cycles matters. The Nation

- Industrial logic and anchor tenants. Zones work when they cluster: a few scale anchors, a web of suppliers, and a port-to-factory logistics solution. Generic “city” branding is weaker than a targeted value proposition (e.g., building-materials cluster tied to Saudi giga-projects; agro-processing for GCC food security; medical devices with export certification pipelines). The sectoral breadth in the MoU must be narrowed into bankable clusters. radio.gov.pk

What would it take—concretely—to cross the MoU chasm?

Think in layers: governance, bankability, and market fit.

Governance. Create a dedicated SPV (with minority Saudi participation if desired) that owns land assembly, infrastructure contracting, and one-stop services. Hard-code the “Zero Time to Start” policy into the SPV’s license with measurable service-level guarantees: NOCs in ≤15 days; utility connections in ≤60 days; building permits in ≤30 days. Publish quarterly dashboards. Tie senior-official bonuses to SLA compliance. The Nation

Bankability. Package the zone as a PPP with viability-gap funding for offsite infrastructure, ring-fenced through an escrow fed by lease receipts and provincial transfers. Offer step-in rights to lenders and standardized long-term land leases. Use the federal SEZ incentive stack—10-year income-tax holiday and capital-goods exemptions—then layer performance-based provincial perks (e.g., payroll subsidies tied to verified jobs; accelerated depreciation on green equipment) to avoid open-ended fiscal leakage. invest.gov.pk

Market fit. Run a two-track commercialization strategy: (1) recruit 3–5 anchor tenants with export pipelines aligned to Saudi/GCC demand (construction materials, food processing, logistics warehousing, medical disposables), offering bespoke plot-plus-build-to-suit deals; (2) curate an SME supplier park with modular sheds and shared services (testing labs, cold-chain, certification support). Negotiate mutual recognition for standards where possible to shorten time-to-market. radio.gov.pk

Risk management. Pre-agree a convertibility backstop for dividend repatriation (e.g., staged remittance windows or partial local-currency hedges) and embed international arbitration for disputes. For power, procure a dedicated feeder or on-site hybrid power with guaranteed uptime metrics and penalties for non-performance.

Execution cadence. Publish a 24-month Gantt with five gates: (G1) land & SPV formed; (G2) offsite utilities contracted; (G3) first three anchor term sheets; (G4) 30% plots leased; (G5) first production line commissioned. MoUs too often fade because no one is accountable for the next concrete milestone.

A fair evaluation

On merit, the concept is credible: Saudi risk appetite plus Punjab’s policy tweaks and Pakistan’s SEZ incentive law form a viable scaffold. The weak leg is execution: Pakistan’s investment climate has been volatile, and infrastructure-to-factory conversion is unforgiving. The good news is that the policy levers to de-risk are known and, in parts, already legislated. The bad news is that they must be delivered with boring, relentless competence—not more ribbon-cuttings. invest.gov.pk

Ending on justified optimism—and a roadmap

If Punjab converts the MoU into a site-specific, time-bound, SLA-driven project—anchored by 3–5 exporters tied to GCC demand—the upside is meaningful: thousands of direct and indirect jobs, investment-grade industrial infrastructure, technology spillovers into local SMEs, and a reputational upgrade that lowers Pakistan’s cost of capital for the next project. The elements are in reach: a provincial fast-track policy, a federal SEZ incentive regime, and a willing investor bloc in Saudi Arabia. Now it’s about sequencing and discipline. The Nation

Way to realize the MoU—and deliver results:

- Lock the SPV + land bank within 60 days; publish parcel maps and utility plans.

- Issue a Model Concession & Lease with lender step-in rights and arbitration.

- Secure power reliability via a dedicated feeder or on-site generation with contractual uptime.

- Sign anchor tenant term sheets before mass marketing; cluster around 1–2 sectors to start.

- Operationalize a true one-stop window with enforceable SLAs and a grievance redressal portal.

- Provide FX comfort mechanisms for repatriation and capex imports; communicate them clearly.

- Tie all provincial sweeteners to verifiable performance (jobs, exports, capex) to keep the fiscal math honest.

Do those things, and the “industrial city” moves from slogan to skyline—transforming an MoU into machines humming, containers moving, and families prospering.

Leave a Reply