Q2’s 3.8 % Surge of US Economy: Real Boom or Statistical Mirage?

US GDP Q2 2025: A summer boom — or a sneaky statistical illusion? What the U.S. economy’s surprising growth revision tells us about real momentum.

The Headline That Turned Heads: US GDP Q2 2025

The U.S. economy just looked a lot stronger than we thought. The Bureau of Economic Analysis revised second-quarter GDP (US GDP Q2 2025) growth upward to 3.8 % annualized, far above the initial 2.8 % estimate. On the surface, this paints a picture of an economy roaring ahead despite inflation worries, higher interest rates, and a shifting trade environment.

But growth numbers are like looking at a stage play: the headline figure is the spotlight, while much of the real drama happens in the shadows. To understand whether the U.S. economy is genuinely booming, we need to peek behind the curtain.

What Actually Changed US GDP Q2 2025 Growth in the Revision

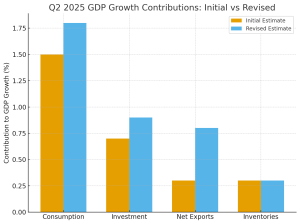

The revision came from adjustments in consumer spending, business investment, net exports, and inventories.

-

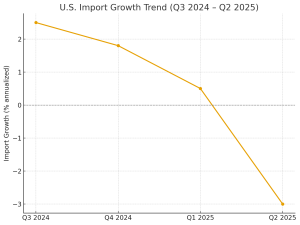

Imports fell sharply — and because imports subtract from GDP, that mechanically boosts the number. But a fall in imports doesn’t always mean strength; it could reflect weaker domestic demand or firms running down inventories.

-

There are arguments for surge in US GDP Q2 2025 that the U.S. economy has genuine momentum:

-

Resilient consumers: Even with real incomes squeezed, households are still spending. Service-sector demand has proved surprisingly durable.

-

Corporate firepower: Balance sheets remain healthy, with companies using strong profits to invest — particularly in tech, AI, and digital infrastructure.

-

Global capital magnet: As geopolitical tensions rise, the U.S. continues to attract foreign capital and re-shored supply chains.

-

Innovation cycle: The AI investment boom is beginning to look like a genuine productivity push, not just hype.

In other words, this isn’t purely smoke and mirrors.

-

Why We Should Remain Skeptical

Yet caution is warranted. The details reveal some cracks:

-

The import drop may reverse. Tariff distortions and pre-buying behavior skewed trade flows; this won’t hold forever.

-

Outside of tech, investment is sluggish. Manufacturing capex and housing remain soft.

-

Labor market cooling. Job openings are down, hiring has slowed, and wage gains are losing steam.

-

Inventory quirks. Positive contributions from inventories often unwind in subsequent quarters.

In short: the 3.8 % may flatter to deceive. Growth could be overstated, while underlying demand momentum looks less robust.

The Fed’s Dilemma

This revision complicates the Federal Reserve’s balancing act.

-

Case for patience: Stronger GDP suggests the economy isn’t collapsing under higher rates, giving the Fed cover to hold back on aggressive cuts.

-

Risk of over-tightening: But GDP is backward-looking. If the Fed interprets strength too literally, it risks leaving policy too tight as momentum fades.

The Fed faces what I’d call a “data mirage trap” — reacting to noisy backward data while forward indicators (surveys, leading indexes) signal cooling.

Implications Beyond Policy

For households: If the boom is real, wages and jobs could remain stable, but if it’s a mirage, households may soon face a slower income trajectory.

For businesses: Capital allocation should be cautious — especially in sectors outside AI/digital where growth is patchier.

For markets: Equity valuations priced for continued strong growth could face turbulence if Q3/Q4 data disappoints.

For policymakers: Overreliance on headline GDP is dangerous; structural reforms (on productivity, fiscal sustainability, trade) matter more than quarterly noise.

The Provocation: Mirage with a Silver Lining?

Here’s my take: the 3.8 % revision overstates true underlying strength. Much of the boost came from technical quirks in imports and inventories. But that doesn’t mean the U.S. is on the edge of recession either. A fairer reading is that the economy remains resilient but is decelerating beneath the surface.

The silver lining? Even if this is partly a mirage, it highlights how America’s innovation-driven sectors (AI, IP, digital investment) are carrying more weight in the growth mix. That may foreshadow a new cycle of productivity — if it spreads beyond tech.

What to Watch Next

To gauge whether Q2’s strength was real or illusory, keep an eye on:

-

September jobs data — if hiring cools further, demand is softening.

-

Retail sales — a better read on household strength than GDP.

-

Industrial production & manufacturing surveys — to see if non-tech investment is stabilizing.

-

Trade flows — if imports rebound, the Q2 GDP bump could evaporate.

-

Fed minutes — clues on how seriously policymakers take the GDP revision.

Closing Thought

Quarterly GDP revisions are like weather forecasts — they grab attention, but can be misleading. What matters is the climate. And the climate of the U.S. economy is one of resilient but uneven growth, with innovation masking some underlying fragility.

The 3.8 % surge? Enjoy the sunshine, but don’t forget your umbrella.

Leave a Reply